GETPAID

Automate your credit-to-cash cycle

Gain efficiency, reduce DSO, and enable sellers with real-time insights.

GETPAID allowed us to be scalable. It provided us with better visibility into what the teams are doing. One of the biggest benefits for us is how easy it is to change priorities to achieve collection and cash flow targets.

Geoff Last

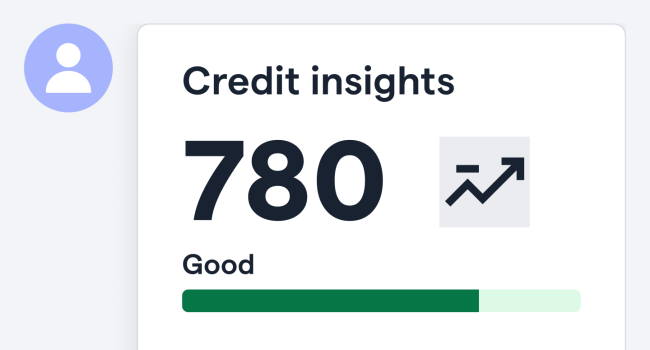

Customer risk assessment

AI scores your customers based on likelihood of delinquency, so you can set the optimal payment terms for each customer and limit the risk of defaults in your portfolio.

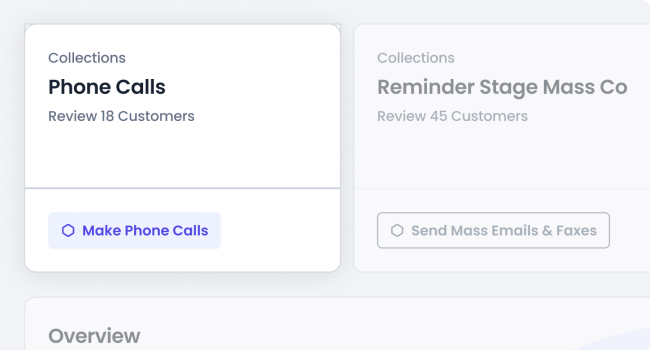

Collaboration and visibility

Clear dashboards and customer management ensures your team can work collaboratively on collections strategies and prevents accounts from slipping through the cracks.

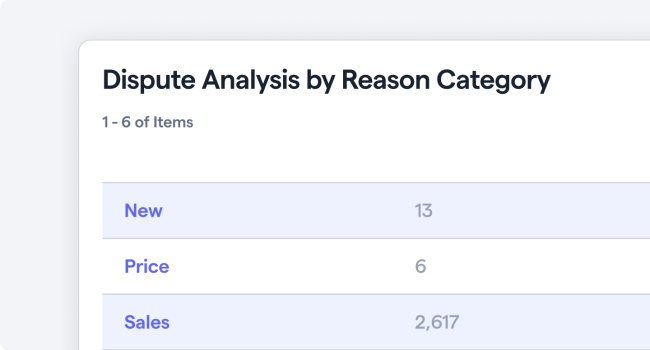

Accelerated outreach & follow-up management

GETPAID identifies disputes and deductions at an ongoing basis, automatically routing them to the right teams for resolution.

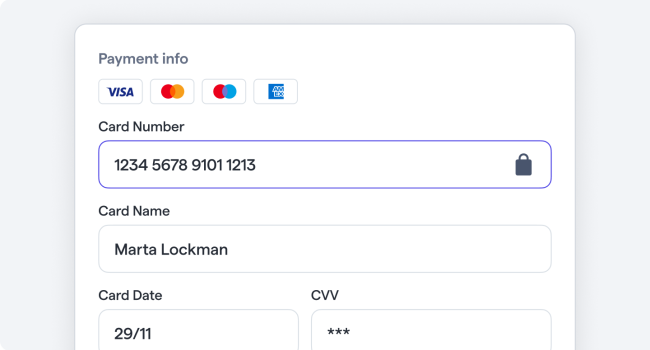

Easy payment and automated cash application

Embedded payment links to let your customers pay seamlessly, and automated cash application reduces manual work and redundant follow-ups.

Driving scalable growth with automated processes

Rexel Canada increased revenue with the same resources by streamlining their AP/AP workflows.

View case study on Driving scalable growth with automated processes